Death is not easy. Sure, a passing that is expected is a little bit easier to swallow than one that suddenly occurs, but either way you can be left heartbroken. When financial stress around a legacy plan adds to the stress during this time, families have been broken apart when they should be holding each other close. If you are adamant that this type of situation doesn’t happen to your family, it is important to go ahead and focus on getting your surrounding family in line with your legacy plan. Read Full Article

Death is not easy. Sure, a passing that is expected is a little bit easier to swallow than one that suddenly occurs, but either way you can be left heartbroken. When financial stress around a legacy plan adds to the stress during this time, families have been broken apart when they should be holding each other close. If you are adamant that this type of situation doesn’t happen to your family, it is important to go ahead and focus on getting your surrounding family in line with your legacy plan. Read Full Article

Should You Provide A Gift to Your Tenant From an Estate Plan?

If the land that you own has had a consistent tenant year after year performing operations such as farm work or running a business, chances are that you probably have a close relationship. When reviewing your estate plan, the question becomes whether or not you should include a monetary gift to your tenant. Whether it is a few thousand dollars or a few hundred thousand dollars, this is a decision that should be thoroughly thought through. Working with a financial expert that specializes in estate planning is your best bet to ensure that all parties involved are treated well. A financial advisor can walk through the goals that you have in place for your estate plan and help to make sure that those goals are achieved. Read Full Article

If the land that you own has had a consistent tenant year after year performing operations such as farm work or running a business, chances are that you probably have a close relationship. When reviewing your estate plan, the question becomes whether or not you should include a monetary gift to your tenant. Whether it is a few thousand dollars or a few hundred thousand dollars, this is a decision that should be thoroughly thought through. Working with a financial expert that specializes in estate planning is your best bet to ensure that all parties involved are treated well. A financial advisor can walk through the goals that you have in place for your estate plan and help to make sure that those goals are achieved. Read Full Article

Should You Provide A Gift to Your Tenant From an Estate Plan?Read More

Are You Making One of These 6 Retirement Errors?

It might surprise you the mistakes that can derail your retirement plan.

It might surprise you the mistakes that can derail your retirement plan.

Retirement planning can be a tricky area to navigate because it involves hundreds of rules, and violating them can result in unnecessary taxes and penalties. It’s no surprise that many retirees have made costly errors in their golden years. It’s just another reminder about the benefits of an independent, fee-only, fiduciary financial planner. Read Full Article

3 Questions Regarding Your Estate Plan

With so much going on in our daily lives, it is difficult to keep up with things like your estate plan. However, if you sit down and think about it, staying up to date with your estate plan should actually be a top priority. Rather than spending time in front of the television or at the nearby bar, consider designating time to update your estate plan. If you don’t know where to even begin when it comes to evaluating your existing estate plan, don’t hesitate to contact our dedicated team at Dunncreek Advisors. While there are a lot of things to consider, you want to make sure that certain questions are addressed during the review of your estate plan. Read Full Article

With so much going on in our daily lives, it is difficult to keep up with things like your estate plan. However, if you sit down and think about it, staying up to date with your estate plan should actually be a top priority. Rather than spending time in front of the television or at the nearby bar, consider designating time to update your estate plan. If you don’t know where to even begin when it comes to evaluating your existing estate plan, don’t hesitate to contact our dedicated team at Dunncreek Advisors. While there are a lot of things to consider, you want to make sure that certain questions are addressed during the review of your estate plan. Read Full Article

Hidden Costs of Mutual Funds

What does it really cost to buy a mutual fund?

What does it really cost to buy a mutual fund?

Almost every retirement portfolio includes some mutual funds. But you may be surprised at the costs you don’t even know you are paying to own these products.

For many families, investments were put in place a long time ago and you may not have looked at them in years. Like your home owners insurance and your physical health, it pays to have a periodic checkup on your retirement account to be sure you are healthy. Read Full Article

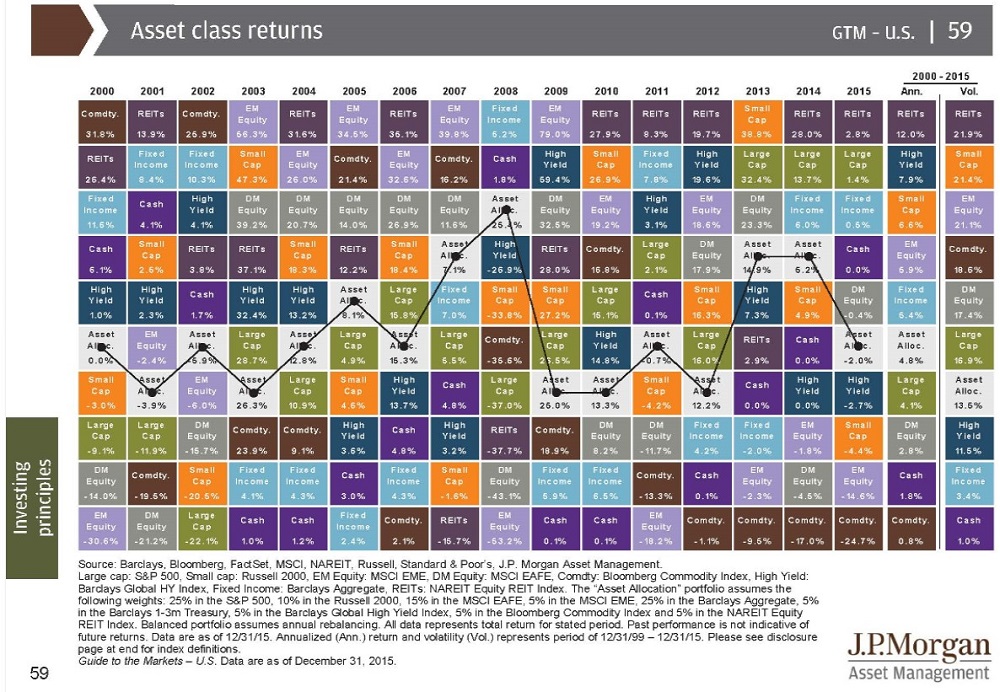

Why Are You Not Beating the Market?

Often people wonder why their personal investment account is not growing as fast as the indexes they hear about in the news.

Often people wonder why their personal investment account is not growing as fast as the indexes they hear about in the news.

Unless your investment account owns all 500 stocks in the S&P 500 in the same proportions as the index, your account CANNOT match the index. And, if your goals call for less volatility than the overall stock market, you will likely own some fixed income investments and a variety of different kinds of stocks in a diversified portfolio. Read Full Article