Have I Missed the Pandemic Rally?

This has been a crazy year. Markets fell about 34 percent in 33 days bottoming out on March 23, 2020, then rebounded to post the best 50 days in history. And as of July 1, the markets celebrated the end of the best 90 days of market performance since 1998. So, with all these surprises — and with all the market growth. It’s easy to ask yourself if it’s too late to participate in the market success.

This is a GREAT reminder of why families benefit so much from working with a seasoned Certified Financial Planner™ professional. To have a fiduciary planner, someone who is specifically and legally bound to be your advocate at all times is a powerful ally. With the experience and training of a CFP® professional you know you will have the best technical process possible. Your fiduciary advocate will listen to your needs and priorities and craft personalized solutions driven by your best interests at all times.

It’s double comfort to know:

First, that your advisor is committed to your best interest and will advocate for you at every step along the way.

Second, that you have an experience and highly trained professional to help you be sure you avoid as many mistakes as possible.

So, even when markets get uncomfortable, you know you have a capable ally who’s looking out for you.

It’s very easy to get distracted by recent history. Humans suffer greatly from what psychologists call recency bias. Recency bias is the tendency to think that whatever just happened will continue. If markets had their best quarter in history in second quarter 2020, then emotionally we feel like it will happen again in third quarter.

Conversely, recency bias also had us convinced on March 23 that the markets would continue their huge slide and fall to zero, and instead that was the day the markets started a record climb. So, what can you do? One thing is to remember a couple of fundamental market truths:

Market Truth #1

Markets bounce around. Markets have had very low volatility up until March of 2020. But, historically markets always bounce around. This chart reminds us that markets (as measured by the S&P 500 index of the largest U.S. companies) AVERAGE a 13.8 percent drop each year (from the highest point to the lowest point), AND the S&P 500 index grows at an average rate of 11.14 percent each year with dividends reinvested.

Yes, stocks bounce around. AND yes, stocks grow in value consistently over time, but only when they are reinvested.

Market Truth #2

Don’t try to time the market. The recent sharp pullback in markets and the big bounce upwards that followed are a reminder that it’s very hard to anticipate what markets will do next. To be successful at timing, you need to anticipate market volatility TWICE. You need to be clear on when to get IN before things go up and then when to get OUT before things go down. Each judgement is really hard, and nobody has a proven track record of doing it. Market timing is a bad idea. If you ride through the bumps and hold a quality investment for 5 or 10 years, you will be rewarded with the higher long-term return.

Market Truth #3

You Can Get Hurt by Too Much Risk, OR by Too Much Stability. It’s easy when markets are so volatile, and we have a huge unknown like the COVID-19 pandemic, to over correct. But, remember you can hurt your long-term financial success with TOO MUCH risk and also with TOO LITTLE RISK.

For example, it would be easy to be afraid of what’s next in the markets right now. One impulse might be to own a really safe investment like U.S. Treasury bonds. These bonds are backed by the full faith and credit of the U.S.A. The world looks to these bonds as one of the very safest investments. That’s why today, the yield on a 30-year Treasury bond is about 1.33 percent. Lots of people are looking for a safe investment, so the interest rate is really low.

But the low return on these safe bonds could crush your retirement plans if you counted on Treasury bond interest to buy your groceries in the future. The historical inflation is about 2.5 percent. That means the cost of most things will double in about 28 years. So the groceries you paid $100 for today will cost $200. That 1.3 percent interest per year will not cover the grocery bill.

Market Truth #4

Don’t Forget the Tax Man. Many investors are focused on saving for retirement. Often that means most of the family’s wealth is held in tax-deferred 401(k) or IRA accounts. These accounts are great. They help you systematically save and they protect your money from taxes while it grows. But, many people forget that traditional 401(k) or IRA accounts also give you a tax break in the year you make the deposits. You can reduce your taxable income with deposits to traditional IRAs and 401(k) which is great because who wants to pay taxes?

But in exchange for the tax reduction now, you agree to pay taxes on ALL distributions in the year you take them. Many of my retired clients are frustrated that every time they take money from retirement savings, they generate an income tax bill. That’s why many of my clients are systematically moving retirement money out of tax-deferred accounts and into Roth IRA accounts. They have decided to pay taxes now while they have income to offset it. That way future distributions from those account will be tax free.

Market Truth #5

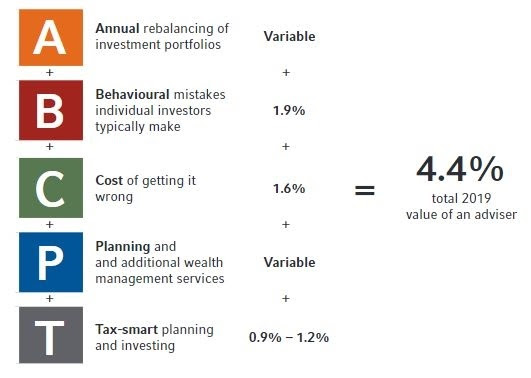

Most People Do Better With Professional Advice. Loads of research shows that families that work with a Certified Financial Planner™ professional or other fiduciary financial advisors are more satisfied with their financial plans. And generally, the outcomes are better. Some studies suggest that an investment of 1 percent of your investment value per year to get professional, fiduciary advice can yield more than 4 percent per year in long-term growth. Of course, your mileage may vary.

If you wonder how much a professional, fiduciary financial planner might help you, I suggest a great place to start is to talk with a couple CERTIFIED FINANCIAL PLANNER™ professionals.

To find a CFP® professional near you, start your search here.

As you visit with financial planners, I suggest a couple things to check:

- Is the advisor always the client’s advocate – a fiduciary advisor?

- Is the advisor only paid by clients, not any financial product manufacturer or distribution network? That would be a fee-only advisor.

These two points help assure that you are working with a professional who is committed to your best interest at all times. It seems sort of obvious to me that a professional would work in this way, but it’s not automatic.

A fiduciary, fee-only, CFP® professional can help you make great retirement income choices and develop a comprehensive financial plan that is driven by your goals and priorities and addresses all aspects of your financial life. With a big-picture approach, you will be better prepared to understand your options at every step along the way.

Yes, I am a CFP® professional. I’m always a fiduciary and I work on a fee basis. And yes, I’m still taking on a few great families to join my financial planning practice this year.

If this article has you thinking about your own circumstances, contact my office at rdunn@dunncreekadvisors.com. I am always happy to meet with people who are working on their retirement plans. Dunncreek Advisors does not provide legal or tax advice, nor is this article intended to do so.

We Are Half Done with 2020 & What a Long Strange Trip It Has Been

We Are Half Done with 2020 & What a Long Strange Trip It Has Been