Sometimes as we think of moving out of the workforce into retirement, we think that we won’t need much to live on. It’s easy to be wrong, especially when it comes to health care costs.

Sometimes as we think of moving out of the workforce into retirement, we think that we won’t need much to live on. It’s easy to be wrong, especially when it comes to health care costs.

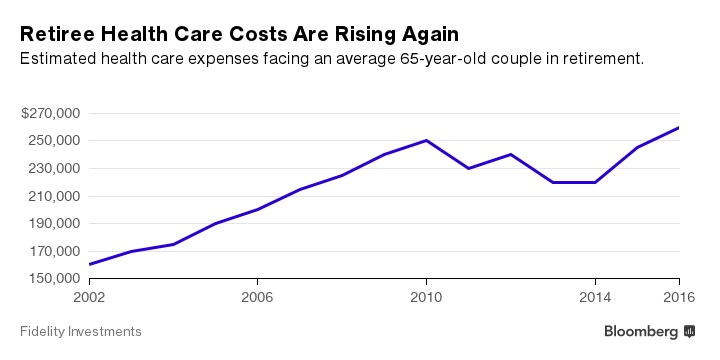

Recent studies show that retirees will need $130,000 each just to cover out of pocket expenses of health care. This is in addition to coverage by Medicare. Read Full Article

Retirement

Is Your Nest Egg Enough?

When you get serious about retirement, one important question is, “How much savings will I need?” Even if you plan to rent out farmland for retirement income, you still need a nest egg.

When you get serious about retirement, one important question is, “How much savings will I need?” Even if you plan to rent out farmland for retirement income, you still need a nest egg.

Part of the challenge to answering the “how much is enough” question, is accurately predicting what your retirement will look like. There are a few moving parts to consider: Read Full Article

Counting Down to Retirement

In order to be successful in retirement start early and count it down carefully.

In order to be successful in retirement start early and count it down carefully.

10 Years Out from Retirement

When you get within 10 years of your target retirement date, it’s close enough to be real. Read Full Article

Five Keys to Winning the Retirement Game

Whether you are 65 or 35, these keys will help you lay the groundwork for a retirement plan that wins for you.

Whether you are 65 or 35, these keys will help you lay the groundwork for a retirement plan that wins for you.

Things just aren’t like they used to be. No more of simply graduating high school and off to the factory. Then 40 years later, retire on a pension, company health insurance and golf 3 times a week. We are all more engaged in making a plan for our own retirement. Read Full Article

Should You Tap Retirement Savings to Fund College?

Many parents wonder whether they should use retirement funds to pay for college for their children. If your child is looking at attending college in the near future and you’re looking for ways to help your child with their college expenses, you may be planning to dip into your retirement fund. But is this the best financial decision for you and your family? Although 30 percent of parents intend to use their retirement funds to pay for their children’s college education, this isn’t the right course of action for all parents. At DunnCreek Advisors in St. Paul, MN, we want to be sure that you make the right financial decision for you and your family, and we’ll help you evaluate the advantages and disadvantages of funding a college education with retirement savings. When you’re trying to decide whether to fund your child’s college education with your retirement savings, consider the following three factors:Read Full Article