The answer to this question is the same as to many financial planning questions: “It depends.” It depends on how much you’ve saved so far and how much you will need to spend during retirement.

But if you are like most Americans, the answer is “no.” A recent survey by GOBankingRates found that 42 percent of Americans have less than $10,000 tucked away for their golden years.

And another report from the Economic Policy Institute (EPI), using 2013 data, found that many Americans are highly unprepared for retirement. The EPI looked at the mean and median retirement savings of working-age families, which it defines as those with wage-earners between 32 and 61 years old.

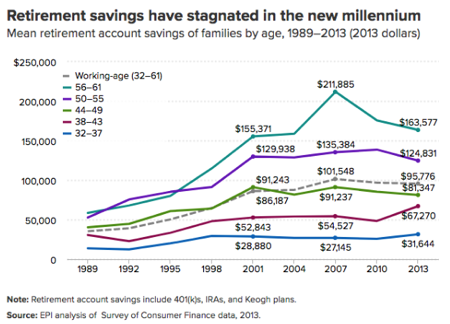

The average retirement savings for these families is $95,776 in 2013 dollars. That sounds considerable but, as the EPI points out, that number doesn’t tell the whole story. Since so many families have zero savings and since super-savers can pull up the average, the median savings may be a better gauge. And the median for all working-age families in the U.S. is just $5,000.

The EPI study found that the average retirement account total looks like across age groups:

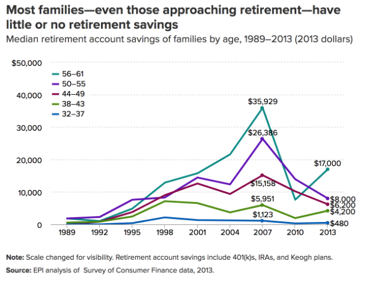

And here’s the median retirement account savings of families by age:

Here’s how the numbers break down for U.S. families at every age:

Age 32 – 37

- Average retirement savings: $31,644

- Median savings: $480

Age 38 – 43

- Average retirement savings: $67,270

- Median savings: $4,200

Age 44 – 49

- Average retirement savings: $81,347

- Median savings: $6,200

Age 50 – 55

- Average retirement savings: $124,831

- Median savings: $8,000

Age 56 – 61

- Average retirement savings: $163,577

- Median savings: $17,000

Age 56 – 61

- Average retirement savings; $163,577

- Median savings: $17,000

If you want to set a goal and work toward saving more, what should you shoot for? One approach is to save based on your current earnings. Experts suggest you can live on 70 percent of the income you earned the year before you retired.

With that target in mind, the brokerage company Fidelity Investments offers these suggestions:

- By 30: Have the equivalent of your salary saved.

- By 40: Have three times your salary saved.

- By 50: Have six times your salary saved.

- By 60: Have eight times your salary saved.

- By 67: Have 10 times your salary saved.

It doesn’t take much time thinking about this—and discussing it with your spouse—to see that it’s complicated and there are some moving parts. That’s why I recommend families take a more comprehensive approach. Have a look at Let’s Make a Plan.org for lots of information about creating a comprehensive financial plan.

Even better is to have the help of a financial planner:

- With comprehensive training in the entire financial planning process: a Certified Financial Planner™ professional

- Who is always his client’s advocate: a fiduciary planner

- Who only gets paid by clients, not a financial product manufacturer: a fee-only planner

Yes, I happen to be a fee-only, fiduciary, CFP® certificant. And yes, I am taking a few new clients this year.

If you want to figure out how much you should save this month to be ready for retirement, contact my office at rdunn@dunncreekadvisors.com. I am always happy to meet with people who are working on their retirement plans. Dunncreek Advisors does not provide legal or tax advice, nor is this article intended to do so.

Why Don’t I Trust My Advisor?

Why Don’t I Trust My Advisor?