It continues to be crazy time in America. In Minnesota, we have a “stay at home” order in place. No school for the kids. No face-to-face meetings. No in-person church. Things are challenging.

We still don’t know exactly how the Great Pandemic of 2020 will turn out. Our first priority is to defeat the COVID-19 virus. Once that is done, we can begin to repair the economy and start moving toward financial goals. The process will take a bit more time. It’s hard to be patient, but it’s the only way.

As we all try to patiently wait out this disease, let’s reflect on a bit of history to gain a little context. Things are bad right now, but we are going to get through this. The United States of America is a great country. We have fought through tremendous challenges over the decades and we will get through this one. We all need to keep the faith and support each other.

Now a bit of perspective . . .

As I write this Monday morning, the S&P 500 index of large companies in the U.S. is down for the day. As of Friday’s market close, the market is:

- Down 15.29 percent from the record high

- Down 10.76 percent for 2020

- Down 1.05 for the last 12 months

- Up 7.62 percent over five years. That’s an average of 1.524 percent per year

- Total return for dividends reinvested for 10 years was 10.954 percent per year (as of April 9 market close)

- Total return for dividends reinvested since 1980 was 11.414 percent per year. (As of April 9 market close)

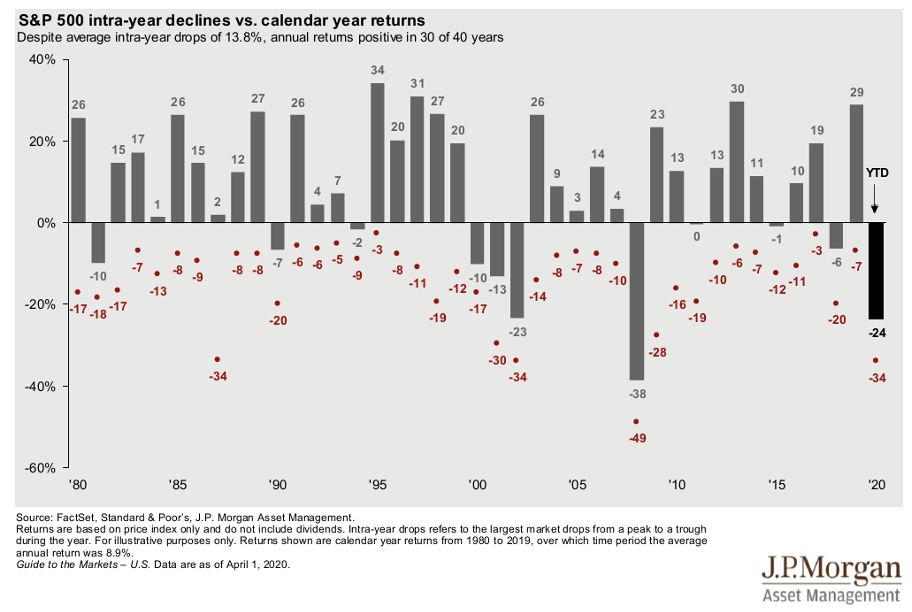

- Annual average intra-year decline since 1980 is 13.8 percent every year

- We’ve had positive returns for 30 of the last 40 calendar years

As the following chart shows, volatility is normal. Stocks move up and down in price all the time. But over time, stocks have grown faster than inflation over the last century. If your goal is to accumulate wealth to fund a future goal, stocks in great American companies will not let you down.

Right now, we are all getting tons of data and information. But what do all these facts mean? What should you do in order to reach your financial goals? It’s hard to know and the answer depends on your specific situation.

A great way to get some answers for your situation is to consult with a CERTIFIED FINANCIAL PLANNER™ professional.

To find a CFP® professional near you, start your search here.

As you visit with financial planners, I suggest a couple things to check:

- Is the advisor always the client’s advocate – a fiduciary advisor?

- Is the advisor only paid by clients, not any financial product manufacturer or distribution network? That would be a fee-only advisor.

These two points help assure that you are working with a professional who is committed to your best interest at all times. It seems sort of obvious to me that a professional would work in this way, but it’s not automatic.

A fiduciary, fee-only, CFP® professional can help you make great retirement income choices and develop a comprehensive financial plan that is driven by your goals and priorities and addresses all aspects of your financial life. With a big-picture approach, you will be better prepared to understand your options at every step along the way.

Yes, I am a CFP® professional. I’m always a fiduciary and I only work on a fee basis. And yes, I’m still taking on a few great families to be part of my financial planning practice.

If this article has you thinking about your own circumstances, contact my office at rdunn@dunncreekadvisors.com. I am always happy to meet with people who are working on their retirement plans. Dunncreek Advisors does not provide legal or tax advice, nor is this article intended to do so.

NEW LEGAL DISCLAIMER LANGUAGE:

Securities and advisory services offered through Royal Alliance Associates, Inc. (RAA),

member FINRA/SIPC.

RAA is separately owned and Dunncreek Advisors LLC,

904 Delaware Avenue, Saint Paul MN 55118, is independent of RAA.

Read this before you open your financial statements

Read this before you open your financial statements