Regular readers of this space know that one of my favorite answers to financial planning questions is, “It depends.” And, of course, the answer to “How much cash is enough?” is “It depends.”

Cash can be very helpful in a portfolio if:

- You hate volatility and wish your portfolio could have fewer sharp declines in value. For example, if you have one-third of your account in cash and two-thirds in the S&P 500 index of large companies, your account will fall about one-third as much the stock index.

- You need to take money out of an account at any point in the next 36 months. For example, if you need to pull $1,000 each month to pay household bills, and you keep $36,000 in cash, you can make those distributions for three years before you need to sell any investments.

Both of these examples illustrate that often cash is not an investment, it’s insurance against short-term changes in investment prices.

Stocks are still important

While cash is important, it’s also important to hold different kinds of investments in your accounts all the time. Hold cash to fund short-term distributions and hold stocks to grow faster than inflation over time.

Remember that over time, owning the S&P 500 means you should expect returns near 10 percent if you hold the investment and reinvest dividends over 10 years or more. So, for retirement money that needs to last for 30 years or more, stocks are an important tool.

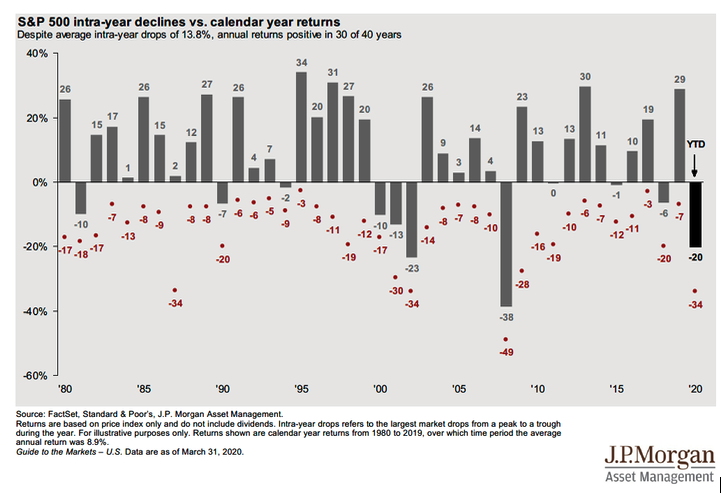

And since history shows that we are very bad at predicting when the market will fall sharply or rise sharply, we need to invest for growth at all times so we don’t miss out. The chart below illustrates that U.S. stocks change price sharply by an average of 13.8 percent each year and over time, stocks grow faster than inflation. Since 1980, the average growth rate of the S&P 500 index of large U.S. companies has grown at an annual rate of 11.057 percent per year with dividends reinvested.

It’s a good reminder that when you are managing investments for a long-term retirement income portfolio you need at least some of that money invested in quality stocks that have historically grown faster than the rate of inflation. And typically, you need to invest for some growth all the time.

A financial planner can help

Clearly there are some factors to consider and

your individual situation will vary. A great place to start looking for great

advice to help you sort things out is to talk with a couple CERTIFIED FINANCIAL PLANNER™ professionals.

To find a CFP® professional near you, start your search here.

As you visit with financial planners, I suggest a couple things to check:

- Is the advisor always the client’s advocate – a fiduciary advisor?

- Is the advisor only paid by clients, not any financial product manufacturer or distribution network? That would be a fee-only advisor.

These two points help assure that you are working with a professional who is committed to your best interest at all times. It seems sort of obvious to me that a professional would work in this way, but it’s not automatic.

A fiduciary, fee-only, CFP® professional can help you make great retirement income choices and develop a comprehensive financial plan that is driven by your goals and priorities and addresses all aspects of your financial life. With a big-picture approach, you will be better prepared to understand your options at every step along the way.

Yes, I am a CFP® professional. I’m always a fiduciary and I only work on a fee basis. And yes, I’m still taking on a few great families to be part of my financial planning practice.

If this article has you thinking about your own circumstances, contact my office at rdunn@dunncreekadvisors.com. I am always happy to meet with people who are working on their retirement plans. Dunncreek Advisors does not provide legal or tax advice, nor is this article intended to do so.

5 Characteristics That Will Get Us Through COVID-19

5 Characteristics That Will Get Us Through COVID-19