Sometimes I get asked by friends and clients, “What should I do about the market decline?”

I often tell them that, unfortunately, by the time the markets have declined, it’s too late to do much. Imagine you just bought a new car. If you don’t have a garage and it’s sitting in your driveway when it starts to hail, do you race out to drive away? Probably not. First, if the hail is heavy enough, it might not be safe to drive. Second, it’s not clear you would drive out of the hail and not drive into more hail. So, once the hail starts, all you can really do is sit tight and hope for the best. From there, you should work to build a garage to keep your car safe from the next hail storm.

It’s the same way with your investments. The best way to protect your assets is to have a specific investment game plan and diversify your holdings to guard against the routine and temporary market fluctuations.

Sound investment principles

Remember the guiding principles that led you to invest in the stocks of great companies in the first place. Over time, there have been few better ways to build wealth than owning shares of great companies. Historical data shows that the 500 largest companies in the U.S. returned 9.84 percent per year since 1928 with dividends reinvested.

But investors should also remember that the stock market is no place for money you will need in the next three years. A market correction (a decline of 10 percent or more) happens about once per year. The average correction only lasts 14 weeks. The Motley Fool has a good discussion of market corrections.

Market volatility is expected

In the first quarter of 2018, we should expect the stock price volatility we have seen so far to continue into the coming months. Remember that 2017 was a surprisingly consistent year. According to data from LPL Research and the St. Louis Federal Reserve, the biggest drop in the S&P 500 during 2017 was just 2.8 percent. It was the smallest annual decline since 1995.

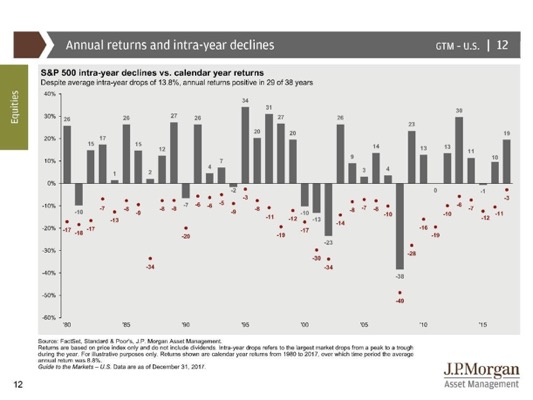

Since we have been so steady for a while, it stands to reason that we might be more volatile soon. Volatility is a normal part of the stock cycle. The chart below is familiar to regular readers of this space. It shows that the S&P 500 has gone up 29 of 38 years since 1980. It also shows the S&P 500 has averaged a 13.8 percent pullback each year over that time. All of this while averaging an 8.8 percent annual growth before dividends.

Volatility can be unpleasant, but it’s natural and your financial plan should anticipate it and help manage it.

Investment strategies for the modern market

A carefully built financial plan will protect you from market declines in several ways:

- You will have a cash reserve emergency fund to provide extra liquidity during a market downturn so you don’t need to sell investments to cover a surprise expense.

- You will know your spending needs and have money available to cover those expenses as they arise. You will not need to sell investments during a downturn to cover basic living expenses.

- You will own a diversified portfolio so that you spread your exposure across many sectors of the market and many regions of the world. This reduces the impact of any single market decline.

- You will monitor and adjust your plan as the situation requires.

The best way to build a great financial plan is to work with an advisor who places your interests first at all times. They will act as your advocate – a fiduciary advisor – and will not get paid based on investment products or strategies, only by you – a fee-only advisor. And, yes, Dunncreek Advisors is a fee-only, fiduciary financial planning firm and we are currently accepting new clients.

If this article has you thinking about what to do in the next market decline, contact my office at rdunn@dunncreekadvisors.com. I am always happy to meet with people who are working on their financial plans.

Dunncreek Advisors does not provide legal or tax advice, nor is this article intended to do so.

How Much Can I Spend in Retirement?

How Much Can I Spend in Retirement?