Imagine if on Monday the Dow Jones Industrial Average was down by 5,326 points. Or if the S&P 500 Index was down by 585 points. That’s about 22 percent in a single day.

Stock market crash

That’s exactly what happened on Black Monday, October 19, 1987. On that day, 30 years ago, stock markets around the world dropped dramatically. The Dow Jones Industrial Average fell 22.61 percent in one day.

For perspective, in the financial crisis of 2008 it took more than 19 weeks for the market to fall 20 percent. So a 20 percent drop on a single Monday morning is a really big deal.

That was about two years after I started saving into my first mutual fund. And yes, I called my financial advisor and added money the week after Black Monday.

Do you remember how much the market was up a year later? 444.76 points (11.93%).

Do you remember when the market hit its new all-time high after Black Monday? August 24, 1989. Less than two years after it bottomed out.

The market has never been as low as Black Monday since. Not even in March 2009 when the DJIA fell to its lowest point of the financial crisis. Such wild swings in a relatively short amount of time should remind us all that investing in the stock market is a long-term strategy, and short-term losses need to be viewed with perspective.

Predicting the stock market

The market is volatile. The daily values of stocks fluctuate. Over time, the value of the largest and most successful companies go up. So the stock markets are sort of like watching a woman using a Yo-Yo on an escalator: Lots of rapid changes in direction with a clear trend upward.

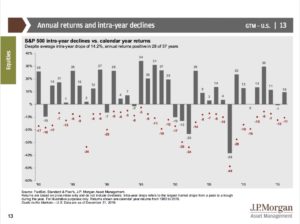

This chart illustrates that volatility is very common. We average a drop of 14.1 percent every year. Yet, in 28 of the last 37 years, the market has ended the year positive. And the S&P 500 used in this example has averaged 8.5 percent return over those 37 years.

It is absolutely true, and I tell my clients all the time, that we are at the top of a market cycle. Sometime in the next two years we will see a recession and market declines. But it’s also true that even knowing that, there is no better way to build wealth for your financial goals than with common stock in great American companies.

Are you worried about the next market decline? Are your investments positioned to absorb the next market shock?

If you are not sure, give me a call. I’m happy to discuss your financial goals and investments.

I am a financial planner who works only for my clients as their advocate (a fiduciary advisor) and I get paid only by my clients (a fee-only advisor). I work to provide wisdom, experience and perspective that help my clients always do the smart thing with their money.

If this article has you thinking about your own circumstances, contact my office at rdunn@dunncreekadvisors.com. I am always happy to meet with people who are working on their retirement and other financial plans.

Dunncreek Advisors does not provide legal or tax advice, nor is this article intended to do so.

What Should I Do About the Tax Overhaul?

What Should I Do About the Tax Overhaul?