A recent study shows that more than 90 percent of investors do NOT know how much their 401(k) costs. You can often reduce the cost of your retirement investments. According to a NerdWallet study, roughly 92 perent of Americans have no idea what they’re paying in 401(k) fees. Many also underestimate their fees and wind …

myRA

Dow 20,000 – It's Just a Number

The Dow reached the 20,000 mark recently. What does it mean? What should you do?

It’s been hard to miss the news that the Dow Jones Industrial Average of 30 U.S. companies recently hit the 20,000 mark. It’s been almost 8 years since the market pullback of the great recession stopped on March 9, 2009 when the Dow closed at 6,547.05. Although we didn’t know it at the time that was the end of a 17-month slide of 54 percent from the prior peak of 14,164.53 in October of 2007.

[caption id="attachment_394" align="alignright" width="300"] Copyright Drew Angerer, Getty Images[/caption]

Copyright Drew Angerer, Getty Images[/caption]

Read Full Article

When Should I Start Saving For Retirement?

At Dunncreek Advisors, we feel as though we get this question a lot. If you are wondering when the best, or right, time to start saving for retirement, the answer is yesterday. We say this not to worry you, but to stress the importance of a solid retirement plan. All over the internet, there are a million calculators telling you how much exactly you should put away. Where do they get their numbers? How does it all work? How can we know when the right time to save is exactly? Don’t worry, Dunncreek Advisors is here to help.Read Full Article

Do Women Outlive Men?

For many couples, the idea of living longer than a spouse can be challenging to think about, but it is often the case that one partner will live longer than another, at least for some small amount of time. For women, it may be important for you to know that women outlive men often times. On average, women outlive men by about five years, which means that you may have five years of expenses, or more, once your partner passes. In order to prepare for this possibility now, it’s important to focus on your retirement plan, investments strategies, and possible extended care investments so that you have your finances in order long before you need to think about how you’ll use them. At Dunncreek Advisors, our St. Paul, MN financial advisors want to help you plan for your retirement, and we’ll help you create a retirement investment strategy that considers the trend of women living longer than men.Read Full Article

Investing for Retirement

While many people in St. Paul, MN, don’t necessarily enjoy getting old, the thought of retirement is sure to put a smile on the face of a lot of individuals. Some people in this country may choose to never retire, but for many of us, it is definitely a goal. Retiring from your place of work is not difficult, however ensuring that you and your family are financially stable at retirement is where the stress occurs. The big question around retirement is where will the money you live off of come from? Chances are that you won’t be winning the lottery soon, so taking the steps now to ensure a stress free retirement is your best bet. At Dunncreek Advisors, we feel that one great way to prepare for retirement is through investing.Read Full Article

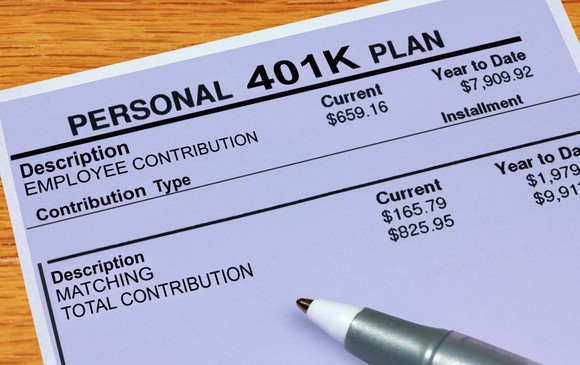

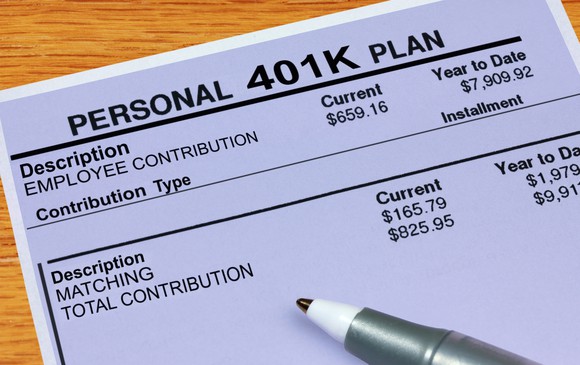

Are You Paying Too Much for Your 401(k)?

A recent study shows that more than 90 percent of investors do NOT know how much their 401(k) costs. You can often reduce the cost of your retirement investments.

According to a NerdWallet study, roughly 92 perent of Americans have no idea what they’re paying in 401(k) fees. Many also underestimate their fees and wind up losing thousands of dollars in retirement savings. Of course, some of the expenses in your plan are set by your employer, but there are things you can do to reduce the bite that comes out of your account.Read Full Article