Congress just passed a controversial tax bill. There has been much discussion about what it “could” mean, but now it’s passed, let’s look at what we know.

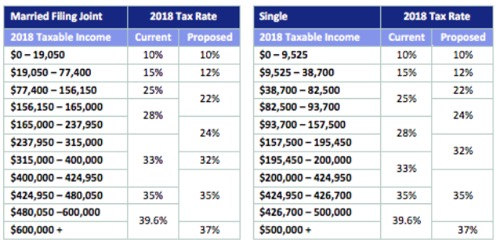

New tax brackets

The number of brackets remains the same at seven, but rates have changed and the income levels to which they apply have moved. Notably, the top rate was lowered to 37 percent from 39.6 percent.

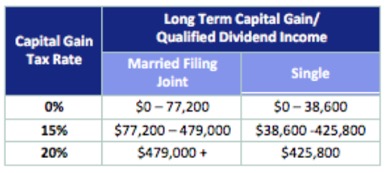

Adjusted capital gains rates

Based on the new brackets, 2018 capital gains tax rates look like this:

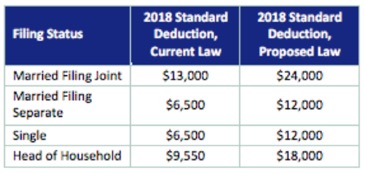

The law repeals the personal tax exemption allowed for each taxpayer and their dependents ($4,050 each). It also increases the standard deduction as shown:

Itemized deductions for state and local taxes

Deductions will be capped at $10,000. This limit covers the combined amount of income tax and property tax paid during the year. However, property tax and sales tax paid by a business are a deductible expense for that business. Foreign property taxes will no longer be deductible.

Charitable contribution limits

Under the new tax bill, charitable contributions limits have increased. The new law allows cash contributions to public charities up to 60 percent of Adjusted Gross Income. That’s up from 50 percent under the previous law.

Miscellaneous itemized deductions

A number of miscellaneous expenses are no longer deductible. This includes tax preparation fees, investment-related expenses, hobby-related expenses, trustee fees, safe deposit box rental and union dues.

Mortgage interest deductions

Things have changed for new mortgages. For mortgages entered into after December 15, 2017, the deduction for interest paid is capped at the first $750,000 of debt. This is reduced from the current $1 million of debt. Existing mortgages are grandfathered, but home equity loan interest is no longer deductible.

All of these changes last until 2025, then everything reverts to the 2017 status.

Individual health insurance mandate

One of the most controversial parts of the legislation, the mandate is eliminated in 2019. There will no longer be a tax penalty for people who choose not to buy health insurance.

Child tax credits

Parents will welcome an increase in child tax credits. The credit goes from $1,000 per child to $2,000 under the new law. Some dependents who do not qualify as a child will qualify for a new $500 credit. For couples with incomes in excess of $400,000, the child credits phase out.

Pass-through business income

Business owners get a break. Partnerships, S Corporations and Sole Proprietorships all receive exemptions for the first 20 percent of net business taxable income. This applies to active and passive business owners.

This exemption does not apply to specified service businesses like healthcare, law, accounting, actuarial sciences, performing arts, consulting, financial services, brokerage services, or any other business where the primary asset is the reputation or skill of its employees.

Engineering and architecture businesses do benefit from the new exemption.

Business structure choices more complex

As a result of the changes to business tax credits (and the new lower tax rate on C Corporations), the decision on how to structure a business just became much more complicated. Consult your tax advisor for information on your unique situation.

Education incentives slightly changed

Section 529 plans can distribute up to $10,000 per year to cover the cost of K-12 expenses while enrolled in a public, private or religious school. The definition of qualified expenses for a 529 account has also been expanded to include certain homeschooling expenses.

If a student loan is discharged due to the death or permanent disability of the student, that discharge would no longer be considered taxable income.

Estate tax changes

The estate exemption doubles to $11.2 million per person and $22.4 million per couple under the new law. Those who had already used their estate exemption in prior years would be able to make additional tax-free gifts to non-spouse beneficiaries next year.

Alternative minimum tax changes

The law increases the exemption amounts. For couples, the threshold moves from $78,750 in 2017 to $109,400 in 2018 (and from $50,600 to $70,300 for singles). The AGI level at which the exemption is phased out would also be increased, from $150,000 in 2017 to $1,000,000 in 2018 for couples (and from $112,500 to $500,000 for singles).

Business tax changes

Businesses organized as C corporations will see taxes reduced from 35 percent to 21 percent.

A helpful summary article on the bill can be found here.

If you think your financial plan should be adjusted based on the new tax law, let’s talk. Contact my office at rdunn@dunncreekadvisors.com. I am always happy to meet with people who are working on their retirement plans.

Dunncreek Advisors does not provide legal or tax advice, nor is this article intended to do so.

Five Investing Traps to Avoid

Five Investing Traps to Avoid