Classic rock fans may remember the Grateful Dead song that goes, “. . . when life looks like easy street, there is danger at your door.” Those lyrics sound like they were written for 2018. It seems everybody is asking when the stock market will top out and pull back.

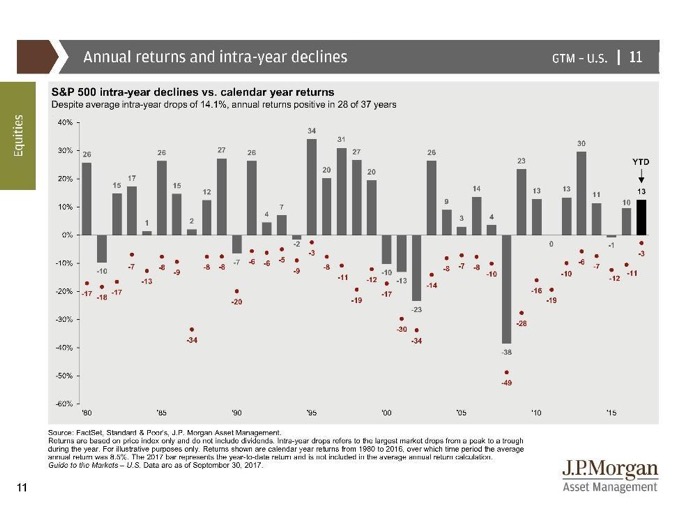

One thing is clear: The market will pull back at some point. After eight years of steady market growth, it’s time for a decline. History nearly guarantees it. In fact, since 1980 there has been at least a 5 percent correction in the S&P 500 value every year except for 1995. And the average correction each year was 14.1 percent.

During those 37 years, the S&P 500 averaged an 8.5 percent return per year and the market closed the year in positive territory in 28 of 37 years.

Steady market conditions

Although the typical pattern has held steady the last 38 years, 2017 stood out in a remarkable way. That’s because 2017 is on track to be the only year in the last 90 years in which U.S. stocks posted positive gains in each of the 12 months. The benign market environment wasn’t just a U.S. phenomenon either. Monthly returns of the broad global equity index showed no extreme up or down performance over the year. That rarely happens.

2018 stock market outlook

All my economic experts tell me that signs continue to favor stocks over bonds in the year ahead. U.S. and foreign economic and monetary policies are pretty stable, and markets around the world expect that to continue. Generally speaking, global interest rates are low, so companies can afford to borrow when they need more funds for growth.

We believe that the markets will likely continue to do well through 2018. We expect that eventually U.S. inflation will rise, volatility will increase and short-term rates will rise above long-term rates. As these conditions emerge, we expect a correction to follow.

But for now, I expect the market to mimic another Grateful Dead song and “just keep truckin’ on.”

If you feel like you need to reevaluate your investments in advance of the next market correction, contact my office at rdunn@dunncreekadvisors.com. I am always happy to meet with people who are working on their retirement plans.

Dunncreek Advisors does not provide legal or tax advice, nor is this article intended to do so.

How Does the New Tax Bill Affect Me?

How Does the New Tax Bill Affect Me?