Most of you know that the S&P 500 Index fell from an all-time high on Feb. 19 into bear market territory (a close down 20 percent from the high) in a record 16 days. And in less than five weeks, it closed down 34 percent from the peak on March 23. This dramatic pullback was because of the onset of the COVID-19 pandemic and the resulting economic shutdown intended to help control it.

Since the last week of March, virus infections and deaths continue to rise sharply, and economic data has been some of the worst on record. Unemployment reported in May for the month of April stood at 14.7 percent. And yet, the market has risen dramatically. As I write, it’s just over 3,200 which puts us about 5.7 percent off the record high and less than 1 percent down for the year-to-date.

Is it smart to invest in stocks now?

So, have you missed out on a great sale of U.S. stocks? Maybe. But then again, maybe the cost of the economic shutdown is not fully appreciated. Perhaps the vast number of Americans who will be unemployed or underemployed by the end of this year will weigh down the investment markets.

But what if we see a repeat of what we saw in March 2009 when job losses reported on March 6 where a shocking 774,000 jobs gone in a month? That following Monday the market bottomed, and proceeded to return, with dividends reinvested, over 16 percent annually for nearly 11 years.

It’s a classic investing puzzle. Humans can find evidence to support any decision they want to make.

When you look for proof, you find it. So, how can you be sure you are being prudent with your investment money in order to provide yourself and your family a comfortable, dignified retirement?

Historical stock market returns

Perhaps a bit of history will help. Since 1926:

- U.S. stocks have averaged about 10% with dividends reinvested

- U.S. bonds have averaged about 6%

- Inflation has averaged about 3%

So, in order to grow your savings faster than inflation, you can own either stocks or bonds, or a mix. And generally, the stocks will return about twice as much real growth after inflation as bonds.

Remember that even at age 60 a couple is planning for at least one of them to need money for 30 years. With that in mind, stocks make a pretty good investment some of your money, most of the time.

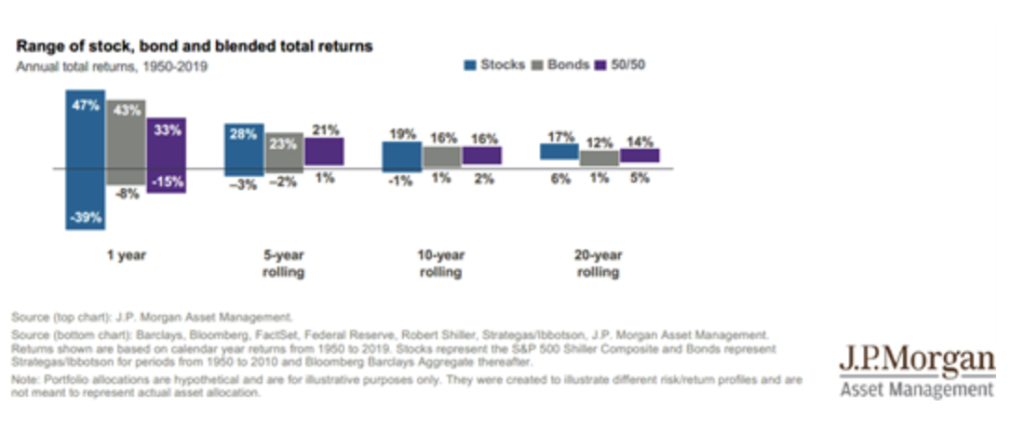

And as this chart shows, if you own both stocks and bonds in a mixed portfolio, and you can wait at least five years before you cash out all the money, you will most likely get returns about twice the inflation rate and you are extremely unlikely to lose money.

Cash is king

So, the question isn’t really about whether you missed the sale on stocks. The question is do you have adequate cash reserves for any bumps in the road the current economy may bring?

Since, most of your “serious money” will be working for the next 10, 20, 30 or 40 years, stocks will deliver excellent growth even if you don’t get in on the lowest price of 2020.

But there are plenty of specific factors to consider. Every family is different. I always suggest that a great place to start evaluating your retirement planning strategy is with a conversation with a couple CERTIFIED FINANCIAL PLANNER™ professionals.

To find a CFP® professional near you, start your search here.As you visit with financial planners, I suggest a couple things to check:Is the advisor always the client’s advocate – a fiduciary advisor?Is the advisor only paid by clients, not any financial product manufacturer or distribution network? That would be a fee-only advisor.

These two points help assure that you are working with a professional who is committed to your best interest at all times. It seems sort of obvious to me that a professional would work in this way, but it’s not automatic.

A fiduciary, fee-only, CFP® professional can help you make great retirement income choices and develop a comprehensive financial plan that is driven by your goals and priorities and addresses all aspects of your financial life. With a big-picture approach, you will be better prepared to understand your options at every step along the way.

Yes, I am a CFP® professional. I’m always a fiduciary and I only work on a fee basis. And yes, I’m still taking on a few great families to be part of my financial planning practice.

If this article has you thinking about your own circumstances, contact my office at rdunn@dunncreekadvisors.com. I am always happy to meet with people who are working on their retirement plans.

Dunncreek Advisors does not provide legal or tax advice, nor is this article intended to do so.

How much cash should I have on hand in case of an emergency?

How much cash should I have on hand in case of an emergency?