Many people wonder if they are at risk to outlive their money. Nobody likes the idea of running out of money in old age. Based on 91 years of market history and some reasonable assumptions, if you have been doing a good job of saving for retirement, you should be fine. Reasonable assumptions for investors …

investor

A Tale of Two Investors

Imagine a client who is very conservative–a risk-averse investor. It’s 1999, and she has watched from the sidelines as tech stocks have skyrocketed. Year after year, she’s seen tech equities beat cash and bonds like clockwork. The client grows convinced that there’s no risk to investing in tech stocks — they only go up. In …

Financial Advice for the New Year

2017 was certainly an interesting year in the world of finance. The gains in the stock market surprised nearly everyone. But will the good news continue in the year ahead? How will things change? We don’t know what the future holds, but great advice is timeless. To help start the new year off right, I’ve …

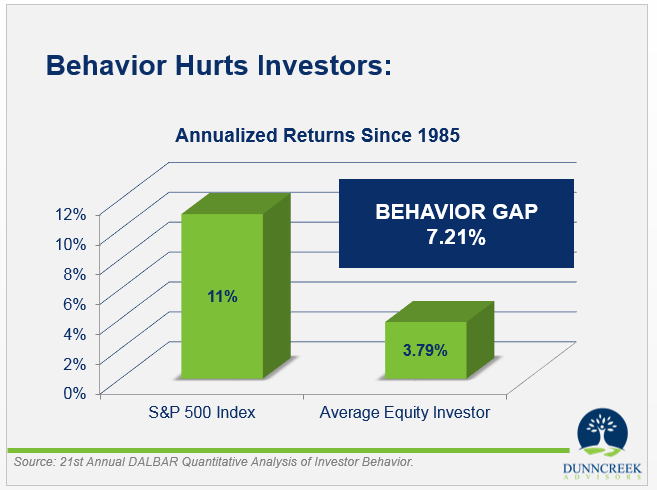

Why Aren't My Investments Doing What I Expected?

Have you ever opened up your investment account statement to find yourself disappointed in the numbers you’re seeing? Many investors are surprised, and often dismayed, by the performance of their investments. The problem might not be the investment, however. It might instead be that you didn’t have a realistic understanding of your investments from the …

Investment Strategies for Retirement

When planning for retirement, there are several factors to consider when creating a realistic retirement plan. While it used to be easy to predict how your retirement would work, these days, it’s not so simple. Many of us have been used to thinking that we should graduate college in our twenties, begin working, start our families in our thirties with an established career, and retire in our sixties. For some, this may be exactly how retirement happens. For others, retirement, and in fact their entire lives, will be much different than this image of ideal retirement and life planning. Don’t worry, though; no matter how unpredictable your career or personal life may be, by planning for your retirement now, you can be sure that you make the right financial decisions today that will ensure a successful retirement down the road. At DunnCreek Advisors, our St. Paul, MN retirement advisors want to help you create a realistic retirement plan for your future. To begin planning your retirement, ask yourself the following four questions:Read Full Article

Four Blind Spots That Can Wreck Your Transition

Whether the transition you face is a transition out of the farming business or just the transition from full-time employment into retirement, beware some common blind spots. When faced with an important life transition, most people struggle with some common blind spots.

1. Decision Overload

As the transition approaches you face loads of choices. When to start the process? What types of advisors to consult? Which individual advisors to trust? How to reduce the risk of a disruption to you plan?

Being flooded with so many questions can be overwhelming. There’s pressure not to mess up. It’s a recipe for procrastination—analysis paralysis. As a result, many people do nothing. But that choice can be harmful to your transition.Read Full Article