Best new year greetings to all my friends and clients who take the time to read this. Thank you for your part in making 2018 one of the best in my professional career. I am blessed to work with wonderful clients, wonderful business partners and wonderful associates. Thank you all for the blessings you bring to my life.

What do we think about the economic outlook for the year ahead?

Lots of people are making predictions about the state of the economy in 2019—and not all of them are great. Let’s remember the big picture. Context is essential to understanding where we are and where we are headed:

- My practice is focused on understanding client goals and then creating and implementing a financial plan that reaches those goals with the fewest surprises possible.

- My practice is not about predicting the behavior of the investment markets or reacting to every bit of financial “news” that crosses the TV screen. This is because my experience—and years of academic research—show that it’s pointless to try to predict and react in the investment markets. These reactions mostly make things worse.

- My advice is based on client goals. If the client has the same goals as last year, my advice will likely be the same as last year. If you have questions about this, maybe we should talk.

Let’s pause to reflect on the current state of the economy

- Interest rates are historically low with the Federal Reserve interest rate at 2.5 percent at year end, even after rate hikes.

- Unemployment is at the lowest rates we have seen in decades. In fact the May jobs report showed more job openings than workers looking for jobs.

- The Federal Reserve Bank of St. Louis says that household debt as a portion of U.S. Gross Domestic Product is the lowest it’s been since the Great Recession.

What about investment markets?

- 2018 was a pretty good year for the stock markets, except for the last quarter. Markets grew at a pace of over 5 percent for the first three quarters of the year.

- Earnings for the S&P 500 grew by more than 17 percent for through June of 2018, according to Standard & Poor’s data.

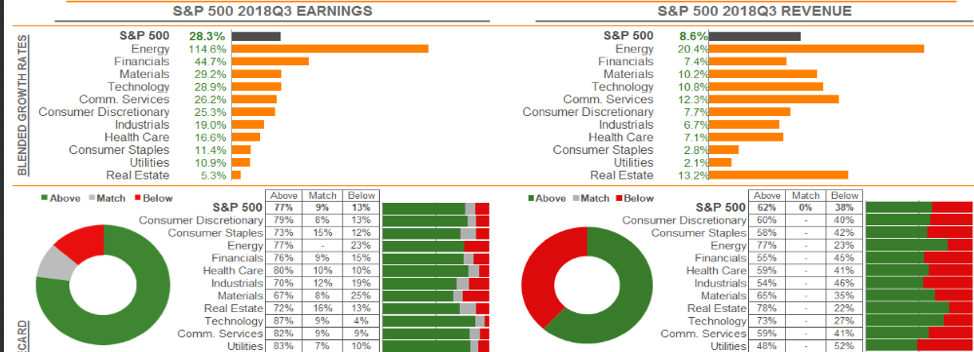

- Most companies in most sectors of the S&P 500 exceeded estimates of earnings and of revenue for Q3 2018.

There are plenty of worries

- The major unknown is trade. Will the U.S. continue disputes with China and other trading partners? Will the disagreements get worse? Will they get better? The uncertainty makes market traders nervous and prices reflect that.

- Will the Federal Reserve continue to raise interest rates? If they do, will it lead to inflation? Will it smother stock market returns? Or will it just restore money market rates to a historically normal range?

And thanks to a 24/7 financial news cycle, we can be sure we will hear about markets and the latest “important developments” instantly and repeatedly. Remember that the financial media is in the entertainment business. Their goal is to keep you interested so that you see the advertisers’ commercials. They are not focused on helping you make great long-term decisions about your financial future.

When markets are uncertain good advice can help

Preparing for the year ahead is an excellent topic for a conversation with your financial planner. If your advisor is a fiduciary advisor – one who is always your advocate – and a fee-only advisor – one who is only paid by you – she can be an excellent resource to help you consider how to adjust your financial plans in the year ahead..

Don’t have a financial planner? I suggest you start by locating a CERTIFIED FINANCIAL PLANNER™ professional in your neighborhood.

CFP® professionals take a multi-faceted approach to your financial planning process that includes budgets, risk protection, retirement planning, investment management, taxes and estate planning. All these related aspects of your financial life are the foundation for a great plan to make the most of the new year.

A CFP® professional can help you create a financial plan that is driven by your goals and priorities and addresses all aspects of your financial life. With a big-picture approach, you will be better prepared to understand your options at every step along the way.

Yes, I am a CFP® professional. I’m always a fiduciary and I only work on a fee basis. And yes, I’m still taking on a few great families to be part of my financial planning practice.

If this article has you thinking about the year ahead, contact my office at rdunn@dunncreekadvisors.com. I am always happy to meet with people who are working on their financial plans. Dunncreek Advisors does not provide legal or tax advice, nor is this article intended to do so.

What’s with All the Market Volatility?

What’s with All the Market Volatility?