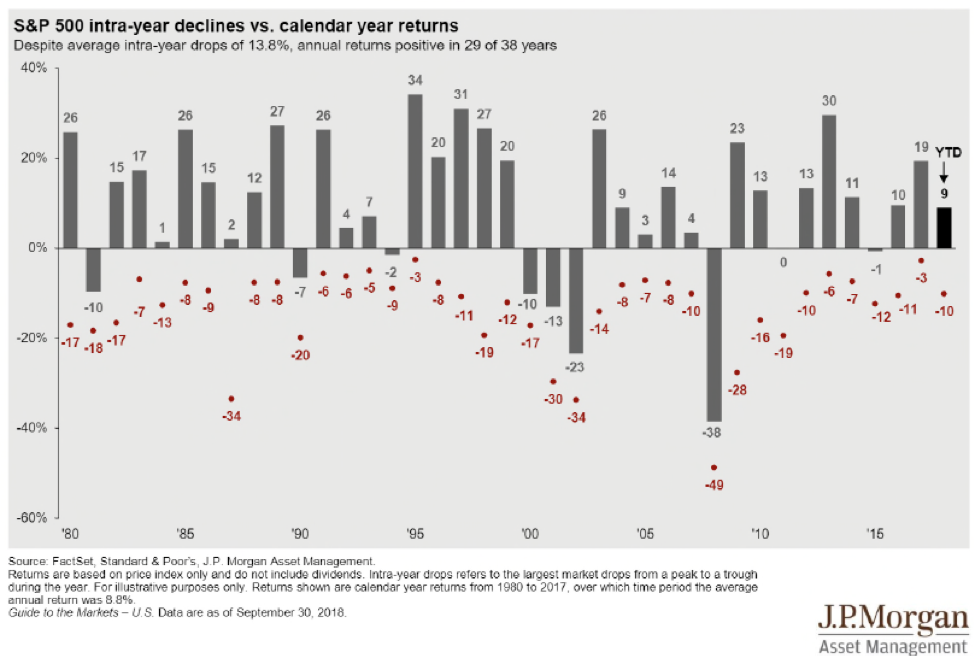

Markets rise and fall over time. With the current bull market stretching back to March of 2009, it can be easy to forget the part about falling. But history shows that the S&P 500 index averages a 13.8 percent decline at some point during each calendar year. And yet, the average annual return since 1980 has been 8.8 percent.

The stock markets are sort of like a yo-yo riding an escalator. They go up and down over short periods. But, fundamentally, the value of good companies rises over time.

The U.S. economy has a history of expansion and contraction. Markets are currently still near the top of nine years of market growth and economic expansion. We are overdue for a market correction and a recession. My best experts expect that the economy will contract in the second half of 2019.

If that’s right, we are still at the top of the cycle as shown below. As we move from Euphoria to Anxiety in the chart, it’s extremely typical to have increased volatility. Many traders are looking for signs of the coming decline and afraid to miss out on another bounce upward. This tug of war makes the markets super responsive to news. And recently, we have had plenty of news every day.

So what’s up with the stock market?

Generally, the economy is healthy and that’s a bit of a cushion to stock markets. So far, company profits remain high, interest rates remain historically low, unemployment is historically low and income taxes are historically low. All these factors make up the economic cushion that is helping keep markets up.

The unsettling news

However, there are events going on right now that make the market volatile:

- Trade. Disputes with China have increase trade barriers and

there is talk of more to come. Every new headline moves the markets.

- Worrisome headlines make and investors sell.

- Optimistic headlines make and investors buy.

- Earnings. The new round of earnings reports will begin in January. Currently, traders are worried that profits will be down. If the reports are positive that’s a lift to the markets.

- Deficit. The fiscal year 2018 deficit is estimated to be $793 billion according to the Congressional Budget Office. Some experts predict the that deficit will exceed $1 trillion by 2020. The growing deficit is a negative factor for the economy and makes many traders nervous.

- Interest rates. The markets have reacted strongly to changes

in the Federal Reserve Fed Fund Rate.

Rates have risen steadily since 2016 rising from 0.25 percent to 2.0 percent. Some

worry that rising interest rates will hurt economic growth. But keep in mind:

- Rates are near historic lows. The highest Fed Funds Rate was 20 percent in March 1980.

- The 30-year treasury bond has a yield of 3.02 percent. This is about half the yield from 2000.

The machines react quickly

More and more investment managers use algorithmic trading to increase efficiency as they manage institutional portfolios. This means that changes in the market driven by these computer programs can come very quickly.

And thanks to a 24/7 financial news cycle we all hear about markets and that latest “important development” instantly and repeatedly. Remember that the financial media is in the entertainment business. Their goal is to keep you interested so that you see the advertisers’ commercials. They are not focused on helping you make great long-term decisions about your financial future.

When markets are uncertain good advice can help

Market volatility is an excellent topic for a conversation with your financial planner. If your advisor is a fiduciary advisor – one who is paid to be your advocate – she can be an excellent resource to will help you consider how to adjust your financial plans based on current market conditions.

Don’t have a financial planner? I suggest you start by locating a CERTIFIED FINANCIAL PLANNER™ professional in your neighborhood.

CFP® professionals take a multi-faceted approach to your financial planning process that includes budgets, risk protection, retirement planning, investment management, taxes and estate planning. All these related aspects of your financial life are what really matter when it comes to reaching your goals.

A CFP® professional can help you create a financial plan that is driven by your goals and priorities and addresses all aspects of your financial life. With a big-picture approach, you will be better prepared to understand your options at every step along the way.

Yes, I am a CFP® professional. I’m always a fiduciary and I only work on a fee basis. And yes, I’m still taking on a few great families to be part of my financial planning practice.

If this article has you thinking about your own circumstances, contact my office at rdunn@dunncreekadvisors.com. I am always happy to meet with people who are working on their retirement plans. Dunncreek Advisors does not provide legal or tax advice, nor is this article intended to do so.

8 Steps to Retirement

8 Steps to Retirement